Stay informed with the October 2024 Tax Newsletter

In this Issue:

- Remind Your Clients of the Important Tax Issues Involving Contributions and Distributions from Online Crowdfunding

- Employer Educational Assistance Programs Can Still be Used to Help Pay Off Workers’ Student Loans through December 31, 2025

- Voluntary Disclosure Program Reopens to Help Businesses with Incorrect ERC Claims

- Business Tax Account Now Gives Many Business Taxpayers New Options for Making Payments Easier; available in both English, Spanish; More Features Coming Soon

- Child and Dependent Care Tax Credit Helps Offset Summer Day Camp Costs

- New Written Information Security Plan Protects Tax Professionals, Their Businesses and Clients and Multi-Factor Authentication: Key Protection to Tax Professionals’ Security Arsenal Now Required

- Department of Treasury and IRS Release Inflation Reduction Act Clean Energy Statistics

- IRS Backlog of Deceased Taxpayer Refunds

- SECURE 2.0 Act Impacts How Businesses Complete Forms W-2

- Tax Pros May be Contacted about IRS survey

- FinCEN Publishes Beneficial Ownership Reporting Outreach and Education Toolkit

- Updated Frequently Asked Questions on New, Previously Owned and Qualified Commercial Clean Vehicle Credits Now Available from the IRS

- IRS Chief Counsel to Combine Large, Small Business Divisions

- Bipartisan Effort Would Add Another Way to Save for Health Care Expenses – NOT YET LAW

- Applicable Federal Rates for October 2024, Rev. Rul. 2024 – 21

***********************************************************************************************************************

We have some very interesting webinars coming up, check out what’s coming soon.

| Ethics: Part 1 | 1 | 10/8/2024 | 1:00pm – 2:00pm | Ethics | Kristy Maitre |

| Ethics: Part 2 | 1 | 10/8/2024 | 2:30 – 3:30pm | Ethics | Kristy Maitre |

| Gift Tax Reporting on Form 709 | 1 | 10/9/2024 | 2:00 – 3:00pm | Fed Tax Law | Randy Adams |

| The Fifth Amendment & Offshore Audits | 2 | 10/16/24 | 12:00pm – 2:00pm | Fed Tax Law | Mike DeBlis |

| Employee vs Independent Contractor | 1 | 10/17/24 | 2:00 – 3:00pm | Fed Tax Law | Larry Johnson |

| Tax Implications of the Gig Economy | 1 | 10/23/24 | 2:00 – 3:00pm | Fed Tax Law | Dr. Laura Dolley |

| Hobby Loss | 1 | 10/24/24 | 2:00 – 3:00pm | Fed Tax Law | Larry Johnson |

| Overview of Form 1040 | 2 | 10/30/24 | 2:00 – 4:00pm | Fed Tax Law | Dr. Laura Dolley |

| Trusts and Estates – Part 1 | 2 | 10/31/2024 | 1:00pm – 3:00pm | Fed Tax Law | Michael Miranda |

| Trusts and Estates – Part 2 | 2 | 11/6/24 | 1:00pm – 3:00pm | Fed Tax Law | Michael Miranda |

| Understanding Financial Statements for Schedule C’s, S Corps & Partnerships | 2 | 11/7/2024 | 1:00pm – 3:00pm | Fed Tax Law | Deltrease Hart-Anderson |

| Ethics: Part 3 | 1 | 11/12/2024 | 1:00pm – 2:00pm | Ethics | Kristy Maitre |

| Ethics: Part 4 | 1 | 11/12/2024 | 2:30 – 3:30pm | Ethics | Kristy Maitre |

| Various Form 1099s | 1 | 11/13/2024 | 2:00 – 3:00pm | Fed Tax Law | Dr. Laura Dolley |

| Quarterly Tax Update 2024: Part 3 | 1 | 11/14/24 | 2:00 – 3:00pm | Fed Tax Update | Kristy Maitre |

| S Corp Basis (Form 7203) and Partnership Basis | 1 | 11/19/24 | 2:00 – 3:00pm | Fed Tax Law | AJ Reynolds |

| Demystifying the FBAR | 2 | 11/20/24 | 12:00pm – 2:00pm | Fed Tax Law | Mike DeBlis |

| SECURE 1.0 and 2.0 Acts | 2 | 11/21/24 | 1:00pm – 3:00pm | Fed Tax Update | Michael Miranda |

| Penalty Abatement | 1 | 12/17/2024 | 1:00pm – 2:00pm | Fed Tax Law | AJ Reynolds |

| Ethics: Part 1 | 1 | 12/18/2024 | 1:00pm – 2:00pm | Ethics | Kristy Maitre |

| Ethics: Part 2 | 1 | 12/18/2024 | 2:30 – 3:30pm | Ethics | Kristy Maitre |

Pricing Info:

$35/hour or Register for the Unlimited Package $249

Webinar Schedule

***********************************************************************************************************************

Issue 1: Remind Your Clients of the Important Tax Issues Involving Contributions and Distributions from Online Crowdfunding

Crowdfunding distributions may be includible in the gross income of the person receiving them depending on the facts and circumstances. The crowdfunding website or its payment processor may be required to report distributions of money raised if the amount distributed meets certain reporting thresholds.

Here are some important basics to keep in mind.

Crowdfunding is a method of raising money through websites by soliciting contributions from a large number of people. The contributions may be solicited to fund businesses, for charitable donations or for gifts. In some cases, the money raised through crowdfunding is solicited by crowdfunding organizers on behalf of other people or businesses. In other cases, people establish crowdfunding campaigns to raise money for themselves or their businesses.

Receipt of a Form 1099-K for distributions of money raised through crowdfunding

The crowdfunding website or its payment processor may be required to report distributions of money raised, if the amount distributed meets certain reporting thresholds, by filing Form 1099K, Payment Card and Third-Party Network.

If required to file a Form 1099-K with the IRS, the crowdfunding website or its payment processor must also furnish a copy of that form to the person to whom the distributions are made. The American Rescue Plan Act (ARPA) clarifies that the crowdfunding website or its payment processor is not required to file Form 1099-K with the IRS or furnish it to the person to whom the distributions are made if the payments are not made in exchange for goods or services.

The reporting thresholds for a crowdfunding website or payment processor to file and furnish Form 1099-K are:

• Calendar years 2023 and prior – Form 1099-K is required if the total of all payments distributed to a person exceeded $20,000 and resulted from more than 200 transactions.

• Calendar year 2024 – The IRS announced a plan for the threshold to be reduced to $5,000 as a phase-in for the lower threshold provided under the ARPA. As of today, we have no official no other official notification from IRS on this amount.

Note: The ARPA lowered the reporting threshold for third party settlement organizations (TPSOs) so that TPSOs are only required to report on Forms 1099-K if the total of all payments distributed to a payee in a calendar year exceeds $600, regardless of the number of transactions. However, implementation of this lower threshold has been delayed.

Crowdfunding distributions may be made to the crowdfunding organizer, or directly to individuals or businesses for whom the organizer solicited funds. Form 1099-K must be filed with the IRS and furnished to the person or entity that received the payments if the reporting threshold is met for the year in which the distributions were made.

A person receiving a Form 1099-K for distributions of money raised through crowdfunding may not recognize the filer’s name on the form. Sometimes the payment processor used by the crowdfunding website, rather than the crowdfunding website itself, will furnish the Form 1099-K and will be listed as the filer on the form. If the recipient of a Form 1099-K does not recognize the filer’s name or the amounts included on the Form 1099-K, the recipient can use the filer’s telephone number listed on the form to contact a person knowledgeable about the payments reported.

Box 1 on Form 1099-K will show the gross amount of the distributions made to a person during the calendar year. But the furnishing of a Form 1099-K does not automatically mean the amount reported on the form is taxable to the person receiving the form.

If non-taxable distributions are reported on Form 1099-K, the recipient should report the transaction on Form 1040, Schedule 1, as follows:

- Part I – Line 8z, Other Income – “Form 1099-K Received for Non-Taxable Crowdfunding Distributions” to show the gross proceeds from the distributions reported on Form 1099-K.

- Part II – Line 24z, Other Adjustments – “Form 1099-K Received for Non-Taxable Crowdfunding Distributions” to show the non-taxable amount of the distributions reported on Form 1099-K.

The net effect of these two adjustments on income is $0.

Alternatively, if non-taxable distributions are reported on Form 1099-K and the recipient does not report the transaction on their tax return, the IRS may contact the recipient for more information. The recipient will have the opportunity to explain why the crowdfunding distributions were not reported on their tax return.

Tax treatment of money raised through crowdfunding

Under federal tax law, gross income includes all income from whatever source derived unless it is specifically excluded from gross income by law. Whether crowdfunding distributions are includible in the gross income of the person receiving them depends on all the facts and circumstances of the distribution.

In most cases, property received as a gift is not includible in the gross income of the person receiving the gift.

If crowdfunding contributions are made as a result of the contributors’ detached and disinterested generosity, and without the contributors receiving or expecting to receive anything in return, the amounts may be gifts and therefore may not be includible in the gross income of those for whom the campaign was organized. Contributions to crowdfunding campaigns are not necessarily a result of detached and disinterested generosity, and therefore may not be gifts. Additionally, contributions to crowdfunding campaigns by an employer to, or for the benefit of, an employee are generally includible in the employee’s gross income.

If a crowdfunding organizer solicits contributions on behalf of others, distributions of the money raised to the organizer may not be includible in the organizer’s gross income if the organizer further distributes the money raised to those for whom the crowdfunding campaign was organized.

Recordkeeping for money raised through crowdfunding

Crowdfunding organizers and any person receiving amounts from crowdfunding should keep complete and accurate records of all facts and circumstances surrounding the fundraising and disposition of funds for at least three years.

Issue 2: Employer Educational Assistance Programs Can Still be Used to Help Pay Off Workers’ Student Loans through December 31, 2025

IRS issued a reminder that employers who offer educational assistance programs can also use them to help pay for their employees’ student loan obligations through December 31, 2025.

Though educational assistance programs have been available for many years, the option to use them to pay for workers’ student loans has only been available for payments made after March 27, 2020. Under current law, this student loan provision is set to expire December 31, 2025.

Traditionally, educational assistance programs have been used to pay for books, equipment, supplies, fees, tuition and other education expenses for the employee. These programs can now also be used to pay principal and interest on an employee’s qualified education loans. Payments made directly to the lender, as well as those made to the employee, may qualify.

In most cases, educational benefits are excluded from federal income tax withholding, Social Security tax, Medicare tax and federal employment (FUTA) tax. By law, tax-free benefits under an educational assistance program are limited to $5,250 per employee per year. Normally, assistance provided above that level is taxable as wages.

Employers who don’t have an educational assistance program may want to consider setting one up. Fringe benefits, such as educational assistance programs, can help employers attract and retain qualified workers.

These programs must be in writing and cannot discriminate in favor of highly compensated employees.

Issue 3: Voluntary Disclosure Program Reopens to Help Businesses with Incorrect ERC Claims

The IRS reopened the Voluntary Disclosure Program for the Employee Retention Credit through November 22 to help businesses correct improper payments at a 15% discount and avoid future audits, penalties and interest. The IRS urges businesses that received Employer Retention Credit payments to recheck eligibility.

The IRS also announced plans to mail up to 30,000 letters to reverse or recapture potentially more than $1 billion in improper ERC claims.

Businesses with pending, unpaid ERC claims should consider the ERC Claim Withdrawal Program that allows the business to remove a pending ERC claim – one that the IRS has not processed yet.

Directions for Responding to Employee Retention Credit Disallowance Letter

Businesses that claimed the Employee Retention Credit may have received IRS Letter 105-C, a disallowance letter, if the IRS identified their claim as ineligible.

A new page on IRS.gov, Understanding Letter 105-C, Disallowance of the Employee Retention Credit, can help tax professionals and business clients learn about next steps if they disagree with the disallowance. This page has information on:

• Rechecking eligibility for the credit before disagreeing

• Responding to the letter, including what documentation to send the IRS

• Requesting an appeal or filing suit and the timelines to do so

Issue 4: Business Tax Account Now Gives Many Business Taxpayers New Options for Making Payments Easier; available in both English, Spanish; More Features Coming Soon

IRS is continuing to expand the features within Business Tax Account (BTA), an online self-service tool for business taxpayers that now allows them to view and make balance-due payments.

Launched the fall of 2023, BTA is a key part of the agency’s service improvement initiative funded under the Inflation Reduction Act (IRA). When fully developed, BTA will allow many types of business taxpayers to check their tax history, make payments, view notices, authorize powers of attorney and conduct other business with the IRS.

With the latest expansion, an eligible business taxpayer can now use BTA to pay Federal Tax Deposits (FTDs) and see and make a payment on their full balance due – all in one place. The account is also now accessible in Spanish with more translations planned.

Who can use BTA now?

Business taxpayers who can activate and use their IRS Business Tax Account include:

- A sole proprietor who has an Employer Identification Number (EIN) issued by the IRS.

- An individual partner or individual shareholder with both:

- A Social Security number or an individual tax ID number (ITIN).

- A Schedule K-1 on file (for partners, from 2012-2023; for shareholders, from 2006-2023).

Currently, a limited liability company that reports business income on a Schedule C cannot access a Business Tax Account. Future access will be available for these businesses, as well as other entities including tax-exempt organizations, government agencies, partnerships, C corporations and S corporations.

What can business taxpayers do now?

Within BTA, business taxpayers can now:

- View and make a payment toward a balance due by using a bank account. This includes a payment on a return filed for the current year as well as late payments for past tax years and Federal Tax Deposits.

- Schedule a payment for any business day for up to a year and cancel a scheduled payment.

- View recently processed payments, including payments made through the Electronic Federal Tax Payment System (EFTPS)online, wire transfers, checks or money orders, and see if any payments were returned or refused.

- Store multiple bank accounts in their online “wallet” to manage tax payments.

- Request a tax compliance check.

- View the business name and address on file.

- Give account access to employees of the business.

- Register for clean energy credits (if eligible).

- View and download transcripts for various payroll, income and excise tax returns.

- Sole proprietors can now download business entity transcripts from their BTA account. The transcript shows entity information like business name, mailing address, location address and more for the Employer Identification Number on file.

- View and download select digital notices including:

What new features will be added to BTA in the future?

Future capabilities made available through funding from the IRA will enable access by all business and organizational entities and help the Business Tax Account become a robust online self-service tool.

To set up a new business tax account, or for more information visit Business Tax Account.

Issue 5: Child and Dependent Care Tax Credit Helps Offset Summer Day Camp Costs

The Child and Dependent Care Tax Credit may be applied to summer day camp expenses. Publication 503, Child and Dependent Care Expenses, provides a detailed explanation of all the regulations, the requirements to apply for the credit and an exception for certain taxpayers who live apart from their spouse.

Many working parents arrange to take care of their younger children under age 13 during the summer. A popular solution is a day camp program, which can sometimes also lead to a tax benefit. Taxpayers who pay for the care of a child, or other qualifying person, so they could work or look for work may be able to take the credit for child and dependent care expenses.

Unlike overnight camps, the cost of day camp may count as an expense towards the Child and Dependent Care credit.

How it works

Taxpayers must have earned income to claim this credit. The credit is calculated based on income and a percentage of expenses incurred for the care of qualifying people to enable taxpayers to work, look for work or attend school.

- Depending on income, taxpayers can get a credit worth up to 35% of their qualifying childcare expenses. At minimum, it’s 20% of those expenses. For 2024, the maximum eligible expense for this credit is $3,000 for one qualifying person and $6,000 for two or more.

- Reimbursed expenses, such as from a state social services agency, must first be deducted as work-related expenses used to calculate the amount of the credit.

- The amount of work-related expenses used to figure the credit generally cannot be more than earned income for the year if single, or the smaller of a spouse’s income, if married.

- Taxpayers who claim it must list the name and address of the day camp on their return, along with the taxpayer identification number unless an exception applies.

Taxpayers can also use the Interactive Tax Assistant on IRS.gov to determine if they can claim this credit.

Issue 6: New Written Information Security Plan Protects Tax Professionals, Their Businesses and Clients and Multi-Factor Authentication: Key Protection to Tax Professionals’ Security Arsenal Now Required

In the sixth installment of the “Protect Your Clients; Protect Yourself” special series, the IRS and its Security Summit partners informed tax professionals of a new, updated Written Information Security Plan (WISP) designed to help safeguard tax professionals from identity theft and data breaches. After a year-long endeavor, the new WISP is an easily comprehensible document created by and for tax and industry professionals to protect client and business data. Tax pros are required to have a security plan under federal law.

In addition, IRS reminds tax professionals that using multi-factor authentication is now more than an important protection for their businesses and their clients – it’s now a federal requirement.

All tax professionals are now required under the Federal Trade Commission’s safeguards rule to use multi-factor authentication, or MFA, to protect clients’ sensitive information. The June 2023 change mandates MFA to strengthen account security by requiring more than just a username and password to confirm an identity when accessing any system, application or device.

The Summit partners noted that implementing MFA is one of the most cost-effective ways to increase security and reduce a tax pro’s fraud and data breach risks. Once in place, MFA helps protect against phishing, social engineering and other types of technology attacks that exploit weak or stolen passwords.

Common MFA examples

The general public makes wide use of MFA these days, so tax pro clients should not be surprised by the extra scrutiny asked of them.

For example, many smartphone users are accustomed to fingerprint or facial recognition that authenticates their identity before unlocking their device. Certain smartphone applications can also rely on that biometric factor along with a PIN or password for app-level MFA.

Many online banks, financial applications and payroll services use MFA to verify account holders’ identities before granting access or allowing high-risk transactions, such as money transfers.

In addition, taxpayers connecting to the IRS will be asked to set up MFA to create an IRS Online Account. After that, to sign in, they will first log in with an email address and password, then receive a one-time passcode by text or call to one’s chosen device and finally enter the passcode into the account to complete sign-in. A bad actor cannot access one’s account without also having their passcode.

MFA required by law

Under the new FTC MFA rules, there’s a requirement to use at least two of the following factors for anyone accessing customer information: something a user knows like a username; something sent to them like numbers texted to a cell phone; or a physical part of them like a fingerprint or facial scan.

In addition, MFA should be used to secure client information on a tax pro’s computer or network, but it should also be used to access client information stored within their tax preparation software. MFA is required by law for all companies – not just tax professionals. The size of the company does not matter. Opting out of using MFA in tax prep software is a violation of the FTC safeguards rules.

Best implementation practices

Tax pros should implement MFA across all their services and data access points.

In addition, they should regularly evaluate current MFA methods, standards and new technologies to stay protected against the latest threats, and they should offer a variety of authentication factors to suit the needs of different users.

Finally, tax pros should always enable MFA within tax software products and cloud storage services containing sensitive client data, and they should never share usernames.

Tax professionals may do the following to report stolen data:

- Share information with the appropriate state tax agency by visiting Report a Data Breach;

- Review and understand the FTC data breach response requirements as part of their overall information and data security plan; and

- Report the incident to their local IRS stakeholder liaison.

Visit the Data Theft information for tax professionals webpage to learn more.

|

Clients should plan their energy improvements to take full advantage of the limits placed each year carefully as the Energy Efficient Home Improvement Credit excess is not allowed to be carried forward and labor is not allowed as part of the credit. The Residential Clean Energy Credit is allowed to be carried forward, but labor is allowed as part of the credit.

Issue 8: IRS Backlog of Deceased Taxpayer Refunds

The IRS has acknowledged that it had a significant backlog of unprocessed tax forms and refunds claimed on behalf of deceased taxpayers but has taken steps to resolve the issue. National Taxpayer Advocate Erin Collins said in her blog that the backlog was the result of paper Forms 1310, Statement of Person Claiming Refund Due a Deceased Taxpayer, received for 2022 and 2023 not being properly processed by the IRS. The IRS has prioritized its processing of Forms 1310 and only had about 1,100 unprocessed returns at the beginning of August.

While the IRS has added Form 1310 to its modernized e-file platform, not all Forms 1310 are supported, and some require paper filing. Unfortunately, the Forms 1310 filed for 2022 and 2023 were not properly processed. If a Form 1310 is unprocessed, the IRS cannot process the associated final return and issue a refund. Because the IRS must manually issue a refund once the Form 1310 has been processed, there were significant delays in issuing the refunds for 2022 and 2023. The IRS has identified the cause of the issue and worked to decrease the backlog of unprocessed Forms 1310 and manually issue the associated refunds.

Issue 9: SECURE 2.0 Act Impacts How Businesses Complete Forms W-2

The Internal Revenue Service reminds businesses that starting in tax year 2023 changes under the SECURE 2.0 Act may affect the amounts they need to report on their Forms W-2.

The SECURE 2.0 Act allows for additional features in various employer retirement plans to encourage use of these plans.

The provisions potentially affecting Forms W-2 (including Forms W-2AS, W-2GU and W-2VI) are:

- De minimis financial incentives (§ 113 of the SECURE 2.0 Act),

- Roth Savings Incentive Match Plan for Employees (SIMPLE) and Roth Simplified Employee Pension (SEP) Individual Retirement Arrangements (IRAs) (§ 601 of the SECURE 2.0 Act), and

- Optional treatment of employer nonelective or matching contributions as Roth contributions (§ 604 of the SECURE 2.0 Act).

De minimis financial incentives

The SECURE 2.0 Act made changes designed to encourage employees to contribute to their employers’ 401(k) or 403(b) plans. These changes allow employers to offer small financial incentives to employees who choose to participate in these retirement savings arrangements.

If an employer offers such an incentive, it’s considered part of the employee’s income and is subject to regular tax withholding unless there’s a specific exemption. For more information, refer to Questions and Answers D-1 through D-6 in Notice 2024-2, published in the Internal Revenue Bulletin.

Roth SIMPLE and Roth SEP IRAs

Under § 601 of the SECURE 2.0 Act, an employer that maintains a SEP or SIMPLE IRA plan can offer participating employees the option to designate a Roth IRA as the IRA to which contributions under the arrangement or plan are made. For more information, refer to Questions and Answers K-1 through K-8 in Notice 2024-2, published in the Internal Revenue Bulletin.

Salary reduction contributions to a Roth SEP or Roth SIMPLE IRA are subject to federal income tax withholding, the Federal Insurance Contributions Act (FICA) taxes and the Federal Unemployment Tax Act (FUTA) taxes. These contributions should be included in Boxes 1, 3 and 5 (or box 14 for railroad retirement taxes) of Form W-2. They’ll also be reported in Box 12 with code F (for a SEP) or code S (for a SIMPLE IRA).

Employer matching and nonelective contributions to a Roth SEP or Roth SIMPLE IRA are not subject to withholding for federal income tax, FICA taxes or FUTA taxes. These contributions must be reported on Form 1099-R for the year in which the contributions are made to the employee’s Roth IRA. The total amounts are listed in Boxes 1 and 2a of Form 1099-R with code 2 or 7 in box 7, and the IRA/SEP/SIMPLE checkbox is checked.

Designated Roth nonelective contributions and designated Roth matching contributions

Under § 604 of the SECURE 2.0 Act, plans can allow employees to designate certain matching and nonelective contributions made after December 29, 2022, as Roth contributions. These contributions are not subject to withholding for federal income tax. In addition, these contributions generally are not subject to withholding for Social Security or Medicare tax. However, for designated Roth nonelective contributions (including contributions that would be treated as matching contributions if the plan were a qualified plan) that are made to a governmental § 457(b) plan, refer to Question and Answer Q&A L‑7 in Notice 2024‑2, published in the Internal Revenue Bulletin.

Unlike regular Roth contributions, designated Roth nonelective and matching contributions must be reported on Form 1099-R for the year in which they’re allocated to an individual’s account. They’re reported in boxes 1 and 2a of Form 1099-R, and code “G” is used in Box 7. For more information, refer to Questions and Answers L-1 through L-11 in Notice 2024-2.

Form W-2 or Form 1099-R reporting

The reporting requirements that apply to contributions made to a Roth IRA under a SEP arrangement or SIMPLE IRA plan, or to a designated Roth account under an applicable retirement plan, depend on the type of contribution made. The table below summarizes these reporting requirements. For more information, refer to the 2024 General Instructions for Forms W-2 and W-3 and the 2024 Instructions for Forms 1099-R and 5498.

| Roth IRA under a SEP Arrangement or SIMPLE IRA Plan | Designated Roth account under an applicable retirement plan | |

| Form W-2 Reporting | Include salary reduction contributions in Boxes 1, 3, and 5 (or box 14 if railroad retirement taxes apply) of Form W-2. Report them in Box 12 using code F (for a SEP) or code S (for a SIMPLE IRA). | Include designated Roth contributions (made in lieu of elective deferrals) in Boxes 1, 3, and 5 (or box 14 if railroad retirement taxes apply) of Form W-2. Report them in Box 12 using code AA (for a section 401(k) plan), BB (for a section 403(b) plan), or EE (for a governmental § 457(b) plan). |

| Form 1099-R Reporting | Report matching or nonelective contributions in Boxes 1 and 2a of Form 1099-R for the year in which the contributions are made to the Roth IRA, using code 2 or 7 in box 7, and the IRA/SEP/SIMPLE checkbox in Box 7 checked. | Report designated Roth matching contributions or designated Roth nonelective contributions in Boxes 1 and 2a of Form 1099-R for the year in which the contributions are allocated to the individual’s account, using code G in Box 7. |

Reminder

Businesses can now complete and print various copies (excluding Copy A) of Forms W-2 (including Forms W-2AS, W-2GU and W-2VI) on IRS.gov for recipients. Any information entered on one copy (excluding Copy A) will automatically appear on the others. Copy A cannot be completed online to print and file with the Social Security Administration.

If a business filed 2023 Forms W-2 without following these new guidelines, they may need to file Form W-2c to correct any errors. Refer to the General Instructions for Forms W-2 and W-3 for details on when and how to file Form W-2c.

Issue 10: Tax Pros May be Contacted about IRS survey

Tax professionals may be randomly selected to take part in a voluntary survey to help the IRS improve services to the tax professional community and taxpayers. Survey invitations will arrive by mail with phone follow-ups. This is not a scam. Please do not hang up. The survey will be conducted through December 6 by ICF, an independent research firm. Tax professionals can complete the survey online or by mail in about 20 minutes. It covers topics like e-filing, due diligence requirements, data security and electronic document submission. All responses are anonymous and confidential. The survey won’t ask for personal info about tax pros or their clients.

Calls will be on weekdays from 8:30 a.m. to 6:30 p.m. local time from a Kansas City area code (816). For more information email [email protected] or call (888) 504-6387.

Issue 11: FinCEN Publishes Beneficial Ownership Reporting Outreach and Education Toolkit

The U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) has issued another resource to familiarize small business owners with beneficial ownership reporting requirements. These reporting requirements are mandated by the Corporate Transparency Act, a bipartisan law enacted to curb illicit finance by supporting law enforcement efforts. This law requires many small businesses to report basic information to the Federal government about the real people who ultimately own or control them.

The toolkit contains templates and sample content that has been structured to allow private, public, and non-profit organizations to share and amplify this important information. The toolkit includes general background on the reporting requirements, as well as templates for newsletters, websites, and emails; sample social media posts and images; and information on how to contact FinCEN.

News Release: https://www.fincen.gov/news/news-releases/fincen-publishes-beneficial-ownership-reporting-outreach-and-education-toolkit

Toolkit: https://www.fincen.gov/boi/toolkit

Issue 12: Updated Frequently Asked Questions on New, Previously Owned and Qualified Commercial Clean Vehicle Credits Now Available from the IRS

IRS has updated frequently asked questions in Fact Sheet 2024-26 to provide guidance related to eligibility rules, income limitations, transfer rules and dealer registration for the New, Previously Owned and Qualified Commercial Clean Vehicle Credits.

These FAQs supersede earlier FAQs that were posted in FS-2024-14 on April 16, 2024.

The FAQs revisions are as follows:

- Topic A: Eligibility rules for the New Clean Vehicle Credit: updated questions 2, 7, 8, 12 and 18, and added questions 15-17.

- Topic B: Income and Price Limitations for the New Clean Vehicle Credit: updated questions 3, 4, and 7-10, and added questions 12-14.

- Topic C: When the New Requirements Apply to the New Clean Vehicle Credit: updated questions 4 and 6.

- Topic D: Eligibility Rules for the Previously Owned Clean Vehicles Credit: updated questions 3 and 12 and added questions 13-15.

- Topic E: Income and Price Limitations for Previously Owned Clean Vehicles: updated question 2.

- Topic F: Claiming the Previously Owned Clean Vehicles Credit: updated question 3.

- Topic H: Transfer of New Clean Vehicle Credit and Previously Owned Clean Vehicle Credit: updated questions 1-3, 11, 12, 14-15 and 18, and added questions 23-30.

- Topic I: Registering a Dealer/Seller for Seller Reporting and Clean Vehicle Tax Credit Transfers: updated questions 4, 13 and 14, and added questions 19-30.

Issue 13: IRS Chief Counsel to Combine Large, Small Business Divisions

The IRS announced on September 18 that the Large Business & International (LB&I) and Small Business/Self-Employed (SB/SE) Divisions will be combined to form a new legal organization — Division Counsel, Litigation and Advisory (L&A) — effective October 6, 2024.

According to a statement from the agency, recent legislation — the Taxpayer First Act of 2019 (P.L. 116-25) and the Inflation Reduction Act of 2022 (P.L. 117-169) — prompted Chief Counsel to review its current field structure.

Chief Counsel generally serves as the legal advisor to the IRS commissioner on the interpretation, administration, and enforcement of the Tax Code.

The consolidation of the LB&I and SB/SE Division Counsel is designed to address Counsel specific issues and priorities and to provide exceptional service to the IRS client. The L&A Division will expand client service through innovation by streamlining, standardizing, and eliminating duplicative practices. Additionally, the L&A Division will have a clear line of sight into litigation and advisory work across the country and ensuring consistency in legal positions.”

The Taxpayer First Act directed the IRS to develop plans for improving the “taxpayer experience” by creating modernized digital tools and self-service online account features. Additionally, the agency committed to a strategy for training and developing its workforce, as well as another roadmap focused on streamlining internal functions through an organizational redesign with the purpose of expediting communication with taxpayers and practitioners and case resolution.

This three-pronged approach was illustrated in a January 2021 Report to Congress on how the IRS planned to implement the Taxpayer First Act, complete with benchmarks for new initiatives and how it intended to measure success in meeting its goals.

Issue 14: Bipartisan Effort Would Add Another Way to Save for Health Care Expenses – NOT YET LAW

Earlier this month, a bipartisan group of lawmakers introduced a bill to create a new type of tax-advantaged savings account to be used for medical expenses. The Health Out-of-Pocket Expense (HOPE) Act (H.R. 9394) would allow anyone with qualifying health coverage to contribute up to $4,000 annually ($8,000 annually for families).

Qualifying health coverage is defined to include those with minimum essential coverage as provided under § 5000A(f), such as coverage on the commercial market or via Medicare or Medicaid. It also includes those covered via the Indian Health Service.

Employers also could contribute to the accounts, up to 50% of the applicable annual limit. But while contributions made by individuals would not be deductible, employer contributions to accounts of those with $100,000 or less in gross income ($200,000 or less for married couples filing a joint return) would be excluded from adjusted gross income.

Distributions from HOPE accounts used to pay for qualified medical expenses would not be included in the beneficiary’s gross income. HOPE accounts would “be similar to a Roth savings account,” explained a press release, but would allow savings specifically for future health care expenses.

Contributions to other types of tax-advantaged health accounts — namely health flexible spending arrangements (FSAs), health savings accounts (HSAs), certain health reimbursement arrangements (HRAs), and Archer medical savings accounts (Archer MSAs) — reduce the maximum amount that may be contributed to a HOPE account in the same year.

Representatives Blake Moore (R-UT), Jimmy Panetta (D-CA), Brian Fitzpatrick (R-PA), Brad Schneider (D-IL), Adrian Smith (R-NE), and Raul Ruiz (D-CA) led the introduction. Panetta explains that HOPE accounts would “incentivize Americans to save for future medical expenses not covered by their insurance.” And Smith added that the accounts would “give American families a new tool to protect themselves and their household finances from a surprise illness or injury.”

Health FSAs. Traditional health plan members and their employers may contribute to a health FSA. Employer contributions that meet certain conditions are excluded from the employee’s gross income both when made and when employees use account funds for medical expense reimbursement.

The maximum annual amount an employee can contribute through salary reductions to a health FSA in 2024 is $3,200.

One important thing to note about health FSAs is that they are subject to the “use-it-or-lose-it” rule, meaning unused funds remaining at the end of the plan year are generally forfeited, unless an exception applies.

HSAs. HSAs are trusts available only to participants in high-deductible health plans, as set forth under § 223(d). Plan members and their employers can contribute funds to an HSA to be used to pay for qualified medical expenses. Employer contributions to HSAs are not included in the employee’s income and are not subject to employment taxes. Distributions for qualified medical expenses, likewise, are tax-free.

The 2024 annual limit on HSA deductions is $4,150 for self-only coverage and $8,300 for family coverage.

HSAs are portable and stay with an individual when they change jobs or leave the workforce. In addition, contributions stay in the account until they are used.

HRAs. HRAs are an employee benefit plan to reimburse employees for certain medical expenses that they and their dependents incur and that are not covered by other forms of insurance. They are funded solely by the employer and not through salary reduction election.

Benefits received by an employee under an HRA are treated as amounts received under an accident and health plan and thus are tax-free.

For 2024, the maximum excepted benefit amount for an HRA is $2,100.

HRA balances at the end of a coverage period can be carried forward to future coverage periods, but do not move with an employee who changes jobs.

Archer MSAs. An Archer MSA is a tax-exempt trust or custodial account to pay medical expenses in conjunction with a high-deductible health plan. However, Archer MSAs have been discontinued, and only active participants as of 2007 may have an Archer MSA, per § 220.

Contributions to an Archer MSA by an eligible individual are generally deductible. In addition, distributions from an Archer MSA for medical expenses and earnings on accounts are generally not taxable.

Issue 15: IRS Provides Table Used to Calculate 2025 Premium Tax Credit

The IRS, in a new revenue procedure, has provided the 2025 Applicable Percentage Table. Taxpayers use this table to calculate their premium tax credit. Rev. Proc. 2024-35.)

The Applicable Percentage Table for 2025 ranges from an initial percentage of 0% when household income is less than 150% of the federal poverty line to 8.5% when household income is 400% or higher. The final percentages have the same range but change at different income levels.

This procedure also provides the indexing adjustment for the Required Contribution Percentage for plan years beginning in 2025. The IRS uses the Required Contribution Percentage to determine whether an individual is eligible for affordable employer-sponsored minimum essential coverage under § 36B..

For plan years beginning in the calendar year 2025, the Required Contribution Percentage is 9.02%.

The new procedure supplements Rev. Proc. 2014-37 and is effective for 2025.

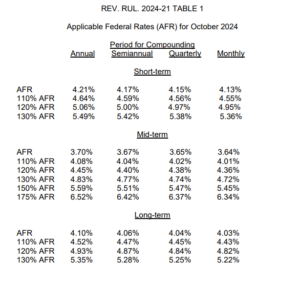

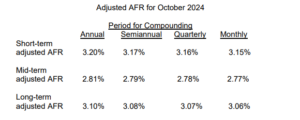

Issue 16: Applicable Federal Rates for October 2024, Rev. Rul. 2024 – 21

REV. RUL. 2024-21 TABLE 2

REV. RUL. 2024-21 TABLE 5

Rate Under Section 7520 for October 2024 4 Applicable federal rate for determining the present value of an annuity, an interest for life or a term of years, or a remainder or reversionary interest 4.4%

![]() Basics & Beyond Resources

Basics & Beyond Resources

- Blog Page

- Resource List

- Webinar & Seminar Schedules

- Get Registered!

- Note: Paid attendees can request a link to the replay of any previously recorded webinar presentations by emailing us at [email protected]