In This Tax Newsletter Issue:

- IRS Backlog for Processing Forms 941 Increasing

- IRS Announces the Creation of a New Office

- New Charitable Remainder Trust IRS Web Page

- IRS Temporarily Made Form 990-T Data Public

- Texas Announces 2022 Fourth Quarter Local Sales and Use Tax Rate Changes

- Michigan Explains Personal Income Tax Treatment of Digital Currencies

- Office of Child Support Enforcement (OCSE) Revises Multi-State Employer Registration Form for New Hire Reporting

- Michigan Issues Guidance on New Law on Reporting Adjustments from Partnership Level Audits

- No State Wants to Be the State Taxing Student Loan Forgiveness

- A Tax Extenders Bill has Potential but Stalled Until Mid-Term Elections

- TIGTA Assesses IRS Compliance with Rules on Contacting Represented Taxpayers

- 2022 Draft Form 945 Annual Return of Federal Withholding Tax Released

- IRS Releases Draft of Schedule R of Annual Return for Agricultural Employees

- Federal Court Rules Individual May Not Sue Employer for Failure to Furnish a W-2

- Bipartisan Senate Bill to Regulate Cryptocurrencies Has Tax Implications

- TIGTA Audit – The IRS’s Inability to Timely Process Noncorporate Applications for Refund of Net Operating Losses Under the CARES Act

- New Address for IRS Substitute Forms Program

- Understanding Federal Tax Obligations During Chapter 13 Bankruptcy Tax Tip 2022-133

- IRS advises That Improperly Forgiven Paycheck Protection Program Loans are Taxable Chief Counsel Advice 202237010

- Chief Counsel Outlines When Contracted Work Qualifies for Research Credit – Legal Advice Issued by Field Attorneys 20223401F

- Applicable Federal Rates for October2022, Rev. Rul. 2022-18

Issue 1: IRS Backlog for Processing Forms 941 Increasing

The IRS backlog for processing Forms 941 (Employer’s Quarterly Federal Tax Return) is increasing, according to the Service’s webpage on mission-critical functions.

The IRS’s webpage on mission critical functions notes that while the Service is open and processing mail, tax returns, payments, refunds and correspondence, the effects of the coronavirus (COVID-19) health emergency continue to cause delays in some of its services.

Form 941 backlog.

One of the items the IRS specifically addresses on its mission-critical webpage is the status of processing Form 941. The IRS says that it is opening mail within normal timeframes. However, as of August 17, 2022, the IRS has a 4.8 million backlog of unprocessed Forms 941. The IRS explains that tax returns are opened in the order they are received and that if an employer filed a return electronically and received an acknowledgement, no further action is required other than promptly responding to any requests for information.

The IRS says that it is working to get through the carryover inventory and stresses to taxpayers not to file a second tax return or contact the IRS about the status of a filed return.

As of July 27, 2022, the IRS reported a 3.4 million backlog of unprocessed Forms 941. Back in May of 2022, the IRS reported that it had a 3.7 million backlog of unprocessed Forms 941. The August 17, 2022, report of a 4.8 million backlog of unprocessed Forms 941 should indicate to employers that there will likely be longer delays in processing with the backlog increasing by more than 1.5 million in a matter of weeks.

Corrected/adjusted returns delayed too. The IRS also informed the public that, as of August 17, 2022, its total inventory of unprocessed Forms 941-X (Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund) was approximately 135,000. The Service noted that some of these corrected returns cannot be processed until the related Forms 941 are processed.

Back in May 2022, the backlog of unprocessed Forms 941-X was at 264,000. As of July 27, 2022, that backlog was 177,000. So, the Form 941-X backlog continues to decrease, which may be a bit of positive news for those who filed a corrected employment tax return that the IRS is getting closer to bringing the backlog to zero.

The IRS explains that while not all these returns involve a COVID-19 credit, the inventory is being worked at two sites (Cincinnati and Ogden) that have trained staff to work possible COVID credits.

Issue 2: IRS Announces the Creation of a New Office

With the IRA now signed into law, IRS Commissioner Chuck Rettig announced to IRS staff this week that one of the first acts will be to create a new office, the IRA 2022 Transformation and Implementation Office, which will be in charge of the implementation of all IRS-related provisions. Rettig tapped Nikole Flax, the Commissioner of Large Business & International, to lead the effort.

The office will have five subsidiary offices that will focus on;

(1) the implementation of new tax law provisions;

(2) taxpayer services transformation;

(3) tax compliance transformation;

(4) human capital transformation, and

(5) communications and outreach efforts.

Inflation Reduction Act Adds Resources to IRS

On August 16, 2022, President Biden signed the Inflation Reduction Act (P.L. 117-169) into law. The legislation contains nearly $80 billion in new funding for the IRS. That funding is to be utilized for enforcement, business system modernization, taxpayer services, and operations support among other items. This additional funding may be vital to mission-critical functions for the IRS, including the processing of Forms 941.

Issue 3: New Charitable Remainder Trust IRS Web Page

Charitable Remainder Trusts | Internal Revenue Service (irs.gov)

Charitable remainder trusts are irrevocable trusts that lets clients donate assets to charity and draw annual income for life or for a specific time period.

IRS closely examine charitable remainder trusts to ensure they:

- Correctly report trust income and distributions to beneficiaries.

- File all required tax documents.

- Follow all applicable tax laws and rules.

The web page access (above) should allow you to link.

Issue 4: IRS Temporarily Made Form 990-T Data Public

The IRS recently discovered that it accidentally made some private machine-readable Form 990-T, Exempt Organization Business Income Tax Return (and proxy tax under § 6033(e)), data available for bulk download through the Exempt Organization Search (TEOS) function on its website. The IRS issued a Sept. 2 statement acknowledging the accidental release of the form information but did not say how many taxpayer records were made available. Numerous media outlets have reported that 120,000 records were made available to the public.

The IRS said it took immediate steps to resolve the issue and that it is continuing to review the situation. The affected files have been removed from IRS.gov and will be replaced with updated files soon. Impacted filers will receive contact from the IRS in the coming weeks.

While the IRS is required to disclose information for §501(c)(3) organizations to the public, the Form 990-T information made available was for a subset of non-§501(c)(3) organizations that are not subject to public disclosure. However, the form 990-T information made available through TEOS did not include Social Security numbers, detailed information on accountholders or information from individual income tax returns. In some cases, the data included the names of individuals or business contact information.

Select State News

Issue 5: Texas Announces 2022 Fourth Quarter Local Sales and Use Tax Rate Changes

The Texas Comptroller of Public Accounts has announced local sales and use tax rate changes, effective October 1, 2022. (New and Additional Tax Rate Changes for Fourth Quarter 2022, Tex. Comptroller of Public Accounts, 09/02/2022.)

City sales and use tax. The City of Smyer (Hockley County) has adopted a city sales and use tax, resulting in a total rate of 8.25%.

The following cities have increased the city sales and use tax, resulting in a total tax rate of 8.25%: Payne Springs (Henderson Co); Shallowater (Lubbock County); Surfside Beach (Brazoria County); and Waelder (Gonzales County).

The following cities have abolished the city sales and use tax, resulting in the following total rates: Ore City (Upshur County), 8.0%; Roanoke (Denton County and Tarrant County), 8.25%; and Rule (Haskell County), 7.25%.

Special Purpose District (SPD) sales and use tax. The following SPDs have imposed a local sales and use tax, with the following local rates: Brazos County Emergency Services District No. 1, 1.5%; Brazos County Emergency Services District No. 3, 1.5%; Brazos County Emergency Services District No. 4, 1.5%; Gonzales County Emergency Services District No. 1, 0.375%; Gonzales County Emergency Services District No. 1-A, 0.125%; Gonzales County Emergency Services District No. 2, 1.125%; Gonzales County Emergency Services District No. 2-A, 0.375%; Hardin County Emergency Services District No. 5, 2.0%; Roanoke Crime Control and Prevention District, 0.5%; Travis County Emergency Services District No. 13, 2.0%; and Tyler County Emergency Services District No. 5, 1.5%.

The Parker County Emergency Services District No. 8 has increased its local sales and use tax to 1.5%.

Issue 6: Michigan Explains Personal Income Tax Treatment of Digital Currencies

Digital currencies such as Bitcoin have become a topic of heightened interest in the media in recent years.

What are digital currencies?

Simply put, digital currencies are forms of currency that are only available in digital or electronic form. You may also hear digital currencies referred to as electronic currency or cybercash. Because they exist only electronically or virtually, digital currencies are accessible only with computers, mobile telephones, or similar devices. Digital currencies have no actual physical attributes, in contrast to the paper dollars and minted coins most people are accustomed to using routinely. Transactions involving digital currencies are conducted using computers or electronic wallets connected to the internet or to designated networks, whereas transactions involving physical currencies can be conducted only when their holders have actual physical possession of these currencies. Accordingly, an advantage of digital currencies is that they enable seamless transfers of value, making transactions both cheaper and faster.

Currently, digital currencies are almost always decentralized, meaning that they are not issued by governments or other financial institutions. However, given certain key advantages of digital currencies and their rising popularity in our increasingly electronic world, many countries around the world are looking seriously at issuing virtual forms of their own paper currencies, which would be backed by the full faith and credit of the government and represent a claim on that country’s central banking system, just as paper currency does. Government-issued digital currencies are known as CBDCs, or Central Bank Digital Currencies. In October of 2020, the Central Bank of the Bahamas issued the Sand Dollar, the world’s first CBDC covering an entire country.

An important type of digital currency is cryptocurrency. A cryptocurrency is a digital currency in which transactions are verified and records are maintained by a decentralized system using cryptography, rather than by a centralized authority, such as a government or central bank. Specifically, a cryptocurrency is an encrypted data string that denotes a unit of currency. Because cryptocurrencies are secured by various encryption algorithms and cryptographic techniques that safeguard the entries, these currencies are nearly impossible to counterfeit or to doubles spend. All cryptocurrencies are digital currencies, but not all digital currencies are cryptocurrencies.

A cryptocurrency is monitored and organized by a peer-to-peer network called a blockchain, which is a distributed ledger enforced by a disparate network of computers. A blockchain is essentially a set of connected “blocks,” with each block containing a set of currency transactions that have been independently verified by each member of the network, making it almost impossible to forge transaction histories. Accordingly, the blockchain functions as the currency’s secure ledger of all transactions, or its permanent record of all purchases, sales, and transfers. Cryptocurrencies are both created and secured through mining, which is the complex process by which the computer network validates individual transactions. The mining process incentivizes the “miners” who run the network by rewarding them with predetermined amounts of cryptocurrency.

Because of the size of the networks, mining virtual currencies consumes enormous amounts of computer resources, and this is clearly one of the disadvantages of digital currencies. As of August 2021, it was estimated to take nine years of household-equivalent electricity to mine a single Bitcoin. Bitcoin is currently the most popular, most widely traded, and most valuable cryptocurrency.

Tax Treatment of Digital Currency Transactions

With respect to the taxation of digital currencies and cryptocurrencies, the treatment of these currencies for federal income tax purposes dictates their treatment at the state tax level. This is because each transaction made by a taxpayer involving Bitcoin or another virtual currency has federal income tax consequences, commonly increasing or sometimes decreasing the taxpayer’s reported income, and ultimately affecting its adjusted gross income, or AGI.

A taxpayer’s AGI as reported on its federal income tax return is the starting point of the Michigan income tax return and the calculation of state income tax. While Michigan permits certain deductions and other adjustments to federal AGI, currently, Michigan does not have any rules or policies with respect to digital currency transactions that differ from the federal policies regarding such transactions.

Federal tax treatment of digital currency transactions is fairly straightforward. Although digital currencies were intended to be a form of money and remain largely unregulated, transactions involving these currencies are treated by the Internal Revenue Service (IRS) like transactions involving property or financial assets such as stocks. General tax principles applicable to property transactions apply to transactions using virtual currencies. Accordingly, digital assets that a taxpayer buys, sells, mines, or uses to pay for things are all subject to income tax, and could result in significant tax liability. Moreover, if a taxpayer is paid in digital currency by an employer or a client, that payment represents taxable income.

Because the IRS views digital currencies as property, it makes no difference in terms of tax liability whether a taxpayer sells the currency as an investment or transfers it to another party as payment for goods or services. Any difference between the taxpayer’s cost of acquiring the digital asset and its value at the time of sale or transfer will be treated as a gain or loss and taxed accordingly.

How digital currency is received or used may have an impact on an individual’s tax liability. For example, successfully mining digital currency (recall that successful miners are rewarded with payment in the digital currency mined) creates an immediate taxable event. A taxpayer is required to calculate the fair market value of the digital currency on the day that it was mined, and federal taxes are owed on that amount. To determine the fair market value, the digital currency must be converted into U.S. dollars. Bitcoin and certain other digital currencies are called “convertible currencies” because they can easily be converted into U.S. dollars or other real currencies based on established exchange rates. The fair market value of a digital currency is whatever the currency’s value was at the date and time the transaction was recorded on the distributed ledger.

A purchase made by a taxpayer using digital currency may also result in federal tax liability. If, for instance, a taxpayer purchased a car using Bitcoin, that individual would need to determine the fair market value of the Bitcoin on the day that the car was purchased and compare that with the amount originally paid for the Bitcoin when it was acquired (the cost basis). Any difference will result in a gain or loss that the taxpayer will report when they file their tax return. If this seems confusing or unfair, think of it as the taxpayer selling the Bitcoin, but instead of getting money for it, they receive another item of value. Digital currency transactions that result in tax liability are further complicated by the fact that tracking tools are currently poor, and the institution where a taxpayer holds digital currency as an investment may not keep track of the cost basis of investors’ transactions or may not formally report it to investors if they do. For that reason, the IRS recommends that taxpayers keep careful records documenting all receipts, sales, exchanges, or other dispositions of digital currency, as well as the currency’s fair market value at the time of each transaction.

Many people are unaware that they are liable for taxes on digital currency transactions, in part because brokerages generally do not send yearly statements to investors regarding digital currency transactions as they are required to do for transfers of other financial assets, such as stocks. The IRS, however, is unlikely to be sympathetic, even if the failure to report digital currency transactions was an honest mistake. In this regard, the 1040 tax return form has recently been updated, and taxpayers are now asked directly on-form whether they have ever received, sold, sent, exchanged, or otherwise acquired any cryptocurrency. Additionally, taxpayers should be aware that the IRS is continually increasing its tracking and scrutiny of digital currency investments.

Taxpayers engaging in transactions involving digital currencies such as Bitcoin may want to consult IRS Notice 2014-21, which gives guidance to individuals and businesses on the tax treatment of transactions using virtual currencies.

Issue 7: Office of Child Support Enforcement (OCSE) Revises Multi-State Employer Registration Form for New Hire Reporting

The Office of Child Support Enforcement (OCSE) has posted a new version of the Multistate Employer Notification Form for New Hire Reporting on its website [OCSE, Multistate Employer Registration Form & Instructions, OMB Control No. 0970-0166, Expiration date: 7/31/25, rev. 08/29/2022].

Employers are required to report all new hires to a state directory for comparison against a state registry of open child support cases to locate parents who have defaulted on their child support obligations. The report must contain the employee’s name, address, Social Security number, and the date of hire (i.e., the date services for remuneration were first performed by the employee), as well as the employer’s name, address, and federal employer identification number (FEIN).

Employers complete the Multistate Employer Notification Form for New Hire Reporting to identify/register their entity as a multi-state employer for new hire reporting. An employer may also file the form to indicate that it is no longer a multi-state employer. Third-party providers must have clients with employees in two or more states to register as a multistate employer.

Online registration available. Employers may also register online at: https://ocsp.acf.hhs.gov/OCSE/.

Employers who submit this form no longer have to notify the Secretary of the U.S. Department of Health and Human Services in writing of their choice to report new hires to only one state.

Change in multistate status. Employers who are no longer a multistate employer must check off the “No Longer a Multistate Employer” box on the form and email the form to: [email protected] or mail it to HHS Administration for Children and Families, Office of Child Support Enforcement, Multistate Employer Registration, PO Box 509, Randallstown, MD 21133.

Issue 8: Michigan Issues Guidance on New Law on Reporting Adjustments from Partnership Level Audits

The Michigan Department of Treasury has issued a Notice providing additional guidance regarding recent legislation that establishes a method for reporting and paying the Michigan income tax on final federal adjustments that arise from a partnership level audit or administrative adjustment request for partnerships subject to the federal Bipartisan Budget Act (BBA) of 2015.

Public Act (PA) 148 of 2022 introduces Chapter 18 within Part 3 of the Income Tax Act, MCL 206.721 et seq., to establish a method for reporting and paying the Michigan income tax on final federal adjustments that arise from a partnership level audit or administrative adjustment request for partnerships subject to the federal Bipartisan Budget Act (BBA) of 2015. Generally, Chapter 18 requires the adjustments to be reported and paid in one of two ways – the partnership may report adjustments to members, who must then separately report and pay their share of the applicable Michigan income tax due (i.e., the “push out” method) or, alternatively, the partnership may elect to report and pay any applicable Michigan income tax on behalf of its members (i.e., the “pay up” method).

There are important statutory deadlines under either reporting method, which include the following:

- A 90-day deadline —

- For all partnerships, to report certain preliminary information about the adjustments to Treasury and to notify Treasury if it will be making the “pay up” election.

- For partnerships that “push out” adjustments, to report to each direct partner their share of the adjustments and, if applicable, pay any Michigan income tax on behalf of direct partners previously included on a composite return.

- A 180-day deadline —

- For direct members of a partnership under the “push out” method, to report their share of adjustments to Treasury and to pay the Michigan income tax owed on those adjustments.

- For a partnership that made the “pay up” election, to pay the collective Michigan income tax owed on those adjustments.

The above deadlines are established by reference to the “final determination date” of the federal adjustment. For federal adjustments arising from a partnership level audit, the “final determination date” is generally defined to refer to the first day on which no federal adjustment arising from the audit remains to be finally determined, including the period of any subsequent appeal. In contrast, for federal adjustments arising from an administrative adjustment request, the “final determination date” is generally defined as the date on which the administrative adjustment request was filed with the Internal Revenue Service (IRS).

Chapter 18 is generally applicable for the reporting of certain federal adjustments for tax years beginning on and after January 1, 2018. Because PA 148 was also given retroactive effect, Chapter 18 will further apply to federal adjustments that have a “final determination date” both prior to and after its date of enactment. While this legislation has therefore created new and, in some cases, immediate obligations for taxpayers in Michigan, the forms, systems, and procedures required for fulfilling those obligations are yet to be fully implemented. Accordingly, this Notice provides additional time for taxpayers to comply with their statutory obligations.

It is expected that the procedures for reporting federal adjustments under Chapter 18 will be available no later than January 1, 2023. As such, for any federal adjustment that is required to be reported under Chapter 18 and that has a “final determination date” prior to January 1, 2023, the Department will regard as timely any reports, elections, and payments that are made as if January 1, 2023, was the applicable “final determination date.” Penalty and interest on such adjustments is also automatically waived if reported timely pursuant to this Notice. Any payments, if applicable, are therefore only required to include the Michigan income tax that may be owed due to that federal adjustment. Effectively, the 90-day and 180-day deadlines referenced above will be treated as beginning on January 1, 2023, for any federal adjustment subject to Chapter 18 that has a “final determination date” prior to that date.

This Notice is limited to those federal adjustments that are subject to Chapter 18 and that have a “final determination date” prior to January 1, 2023. This will neither apply to any federal adjustments with a “final determination date” after December 31, 2022, nor any adjustment to a Michigan return that is required to be reported elsewhere under the Income Tax Act. Taxpayers who fail to report federal adjustments timely as provided in this Notice may be subject to interest and penalty, as applicable, under the Revenue Act.

Notwithstanding this Notice, some taxpayers may wish to report their federal adjustments immediately and either pay any additional tax or claim any available refund. Before doing so, however, the State Partnership Representative must contact the Business Taxes Division for special instruction by calling (517)636-6925. Partners will not be permitted to report, pay, or claim a refund unless the State Partnership Representative files the partnership’s federal adjustments report. There may be additional processing delays in handling these requests.

All future instructions and clarification regarding the implementation of Chapter 18 will be posted to the Department’s website at www.michigan.gov/taxes.

Issue 9: No State Wants to Be the State Taxing Student Loan Forgiveness

There’s good news if your client is eligible for student loan forgiveness: It will not trigger a federal tax bill. And while some may still owe state taxes, it may be fewer borrowers than expected.

It depends on whether and when states conform to federal tax laws, including the American Rescue Plan of 2021 provision making student loan forgiveness federally tax-free through 2025.

The Tax Foundation initially estimated that 13 states may tax student loan forgiveness. The organization has revised projections over the past week as states provided updates. It now projects five states — Arkansas, Minnesota, Mississippi, North Carolina and Wisconsin — may tax student loan forgiveness. Massachusetts has not officially made a determination.

Other News

Issue 10: A Tax Extenders Bill has Potential but Stalled Until Mid-Term Elections

We reviewed expiring provisions in our Fall Virtual Seminars, but some of the provisions have found their way into an extender bill.

And there is still potential for the Enhancing American Retirement Now (EARN) Act and the Securing a Strong Retirement (SECURE) Act 2.0. Hence another “garbage” bill would possibly be created incorporating the many smaller extenders into larger bills in order to get passed.

The new fiscal year begins October 1, but it is expected that a continuing resolution (CR) would be implemented extending any decision making until after the November elections.

Issue 11: TIGTA Assesses IRS Compliance with Rules on Contacting Represented Taxpayers

The Treasury Inspector General for Tax Administration released results of an audit report, Fiscal Year 2022 Statutory Review of Restrictions on Directly Contacting Represented Taxpayers. (Audit Report No. 2022-30-054)

The report analyzed the extent to which field collection employees in the IRS’ Small Business/Self-Employed Division adhere to Code provisions regarding direct contact and fair practices when interacting with taxpayers or their representatives.

Auditors chose a statistically valid stratified sample of 105 taxpayers from a population of 1,365 taxpayers who had collection actions documented by field collection employees during fiscal 2021. A review of case narratives “found no instances” in which agency employees violated a taxpayer’s rights under § 7521 and § 6304(a)(2).

However, the audit revealed an area of concern, stating: “While the majority of Field Collection employees appeared to be familiar with the direct contact provisions and fair tax collection practices, not all revenue officers are familiar with the requirements of the provisions.”

TIGTA interviewed a sample of 20 revenue officers out of the 2,505 field collection employees working for the IRS at the time of the audit. They were presented a hypothetical situation involving a revenue officer’s response to a taxpayer who asked to speak with a certified public accountant about an issue at hand. Four of the revenue officers did not say that they would suspend or reschedule the interview while 16 said they would end the interview and allow consultation times ranging from two to 30 calendar days. According to the audit, the revenue officer is to allow a minimum of 10 business days for the consultation with an authorized representative after a suspended interview.

TIGTA recommended that the IRS issue an appropriate reminder memorandum to all revenue officers and groups managers “reemphasizing the importance of revenue officers following established guidelines and procedures on the taxpayer’s right to representation and direct contact.” The IRS agreed with the recommendation.

Issue 12: 2022 Draft Form 945 Annual Return of Federal Withholding Tax Released

The IRS released the 2022 draft version of Form 945 (Annual Return of Withheld Federal Income Tax). There are no substantive changes from the 2021 version of the form.

Form 945 is used to report federal income tax withheld (or required to be withheld) from nonpayroll payments. If an employer withholds or are required to withhold federal income tax (including backup withholding) from nonpayroll payments, the employer must file Form 945. Nonpayroll payments include a variety of things such as pensions, military retirement, gambling winnings, certain government payments, and payments subject to backup withholding. Employers should report all federal income tax withholding from nonpayroll payments or distributions annually on one Form 945.

The due date for the 2022 Form 945 is January 31, 2023. However, if an employer has made all deposits on time in pull payment of the taxes for the year, the employer may file the return by February 10, 2023. If the IRS receives an employer’s return after the due date, it will treat the employer’s return as filed on time if the envelope containing the return is properly addressed, contains sufficient postage, and is postmarked by the U.S. Postal Service on or before the due date, or sent by an IRS-designated private delivery service (PDS) on or before the due date. However, if an employer does not follow these guidelines, the IRS will consider the employer’s return filed when it is actually received.

The IRS encourages employers to file Form 945 electronically. If an employer files a paper return, where the employer files depends on whether the employer includes a payment with Form 945. The Form 945 instructions includes the mailing addresses for Form 945. There are no changes to the mailing addresses.

If an employer discovers an error on a previously filed Form 945, the employer should make the correction using Form 945-X (Adjusted Annual Return of Withheld Federal Income Tax or Claim for Refund). Form 945-X is filed separately from Form 945.

Employers must use electronic funds transfer (EFT) to make all federal tax deposits. Generally, an EFT is made using the Electronic Federal Tax Payment System (EFTPS). If an employer does not want to use EFTPS, the employer can arrange for your tax professional, financial institution, payroll service, or other trusted third party to make electronic deposits on the employer’s behalf.

Issue 13: IRS Releases Draft of Schedule R of Annual Return for Agricultural Employees

The IRS has released the 2022 draft of Schedule R for Form 943 (Employer’s Annual Federal Tax Return for Agricultural Employees).

Schedule R of Form 943. Employers use Schedule R to allocate the aggregate information reported on Form 943 (Employer’s Annual Federal Tax Return for Agricultural Employees) to each client. Agents approved by the IRS under Code Sec. 3504 and CPEOs must complete Schedule R each time they file an aggregate Form 943. To request approval to act as an agent for an employer under § 3504, the agent must file Form 2678 (Employer/Payer Appointment of Agent) with the IRS. Form 2678 must be previously filed and approved by the IRS before filing Schedule R.

Other third-party payers that file aggregate Forms 943, such as non-certified PEOs, must complete and file Schedule R if they have clients that are claiming the qualified small business payroll tax credit for increasing research activities, the credit for qualified sick and family leave wages, or the COBRA premium assistance credit.

Third-party payers other than agents approved by the IRS under § 3504 and CPEOs need to include client-by-client amounts only for those clients claiming one or more these credits. Amounts for clients not claiming any of these credits are included on Schedule R, page 1, line 8.

What’s new. The 2022 draft Schedule R (Form 943) now designates lines l, r, t, x, and y as “Reserved for future use.” These lines were formerly used to report amounts from Form 943 related to the employee retention credit and advance credits received from filing Form 7200. The 2022 draft instructions for Schedule R (Form 943) have not yet been released.

Issue 14: Federal Court Rules Individual May Not Sue Employer for Failure to Furnish a W-2

A federal district court recently ruled that an individual does not have a private right of action against their former employer for failing to furnish a W-2 [Barker v. Manhattan Parking Group, LLC, SD NY, Dkt. No. 22-CV-6245 (LTS), 08/24/2022].

Denzil Barker was employed as a porter with Manhattan Parking Group LLC. Barker was terminated and filed an age discrimination suit leading to a settlement. Barker received a 1099 rather than a W-2 for the settlement amount. Barker filed suit asserting that he should not have received a 1099 and asked the court to order the employer to furnish a W-2.

What the court said. Under § 6051(a), an employer is required to furnish a Form W-2 to an employee who performed services and received remuneration for which taxes must be deducted or withheld under § 3101 or § 3402.

The court noted, however, failure to furnish a W-2 creates a liability on the part of the employer to the United States and not the employee under §§ 6051 and 6711. The court held that the individual does not have the right to sue an employer for failure to furnish a W-2. Further, the court found that the settlement payment was not “remuneration…for services performed by an employee” and therefore a W-2 was not warranted. Regardless, the former employee did not have standing to sue.

Issue 15: Bipartisan Senate Bill to Regulate Cryptocurrencies Has Tax Implications

Legislation sponsored by a bipartisan pair of U.S. senators, the Responsible Financial Innovation Act (S. 4356), would set new tax rules for cryptocurrencies and shift much of the oversight of them to the Commodity Futures Trading Commission.

The bill creates a de minimis exemption so that people can make purchases with virtual currency without having to account for and report income. The legislation also clarifies the tax treatment of different actors and actions in the digital asset industry, including that “miners” and other validators are not “brokers” for income tax purposes and that their rewards shall not be income until redeemed for cash.

Numerous tax provisions in the measure address:

· Gain or loss from disposition of virtual currency;

· Information reporting requirements imposed on brokers with respect to digital assets;

· Sources of income through digital income;

· Decentralized autonomous organizations;

· Tax treatment of digital asset lending agreements and related matters;

· Implementation of effective IRS guidance;

· Analysis of retirement investing in digital assets;

· Digital asset mining and staking

The bill is not expected to be approved during the current session of Congress as midterm elections loom and other legislative matters are prioritized.

Issue 16: TIGTA Audit – The IRS’s Inability to Timely Process Noncorporate Applications for Refund of Net Operating Losses Under the CARES Act Delayed Taxpayer Refunds and Cost Millions of Dollars in Additional Interest

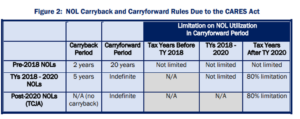

The audit was initiated to assess the IRS’s efforts to ensure individual taxpayers’ compliance with the net operating loss (NOL) provisions associated with the Coronavirus Aid, Relief, and Economic Security (CARES) Act and Form 1045, Application for Tentative Refund. Impact on Tax Administration The CARES Act was passed to financially assist individual and business taxpayers through the pandemic.

§§ 2303 and 2304 of the CARES Act, signed into law on March 27, 2020, made several modifications that temporarily repealed certain restrictions imposed by the Tax Cuts and Jobs Act. Although the temporary repeal provided an opportunity for taxpayers to carry back losses, which were previously limited, challenges in processing a substantial increase in applications for refund associated with these carrybacks has cost the Federal Government at least $42 million in accumulated interest for Fiscal Years 2020 and 2021.

In spite of initial actions to promote more efficient processing of applications for tentative refunds, including the ability to e-fax these applications, the IRS was unable to timely process the large volume of applications and accumulated a large backlog. The IRS is statutorily required to process tentative refund applications within 90 days. However, the number of Forms 1045 considered over-aged (i.e., not processed within 90 days) increased from 900 in Fiscal Year 2020 to 7,585 in Fiscal Year 2021.

The cases remaining in ending inventory (i.e., not processed by the end of the fiscal year) went from 1,626 in Fiscal Year 2020 to 8,974 in Fiscal Year 2021. The overall impact has been negative for both taxpayers, whose potential refunds have been delayed, as well as the Federal Government, which must pay the accumulated interest due to taxpayers on these delayed refunds.

IRS officials stated that CARES Act changes presented a different compliance risk because they were generally more favorable to the taxpayer. As such, they believed compliance risk was not as high as in other areas and made no effort to update examination plans to ensure that taxpayers complied with the provisions of the CARES Act.

Finally, the IRS did not change the criteria it used to identify potentially noncompliant cases during NOL processing that would require further scrutiny by the IRS’s Examination functions despite the large volume of cases and, at times, significant losses being carried back under the CARES Act.

Issue 17: New Address for IRS Substitute Forms Program

The IRS regularly reviews “substitute forms” for approval via its Substitute Forms Program. By IRS definition, substitute forms are those forms which are not produced or published by the IRS but are accepted as substitutes for official IRS forms upon review. For a substitute form or statement to be acceptable to the IRS, “it must conform to the official form, or the specifications outlined” in the revenue procedure. Substitute forms, privately published, may not state that “This is an IRS approved form.”

The IRS has released Publication 1167 (General Rules and Specifications for Substitute Forms and Schedules) to provide official information regarding this process. Other publications address the filing of substitutes for specific forms, such as Publication 1141 (General Rules and Specifications for Substitute Forms W-2 and W-3)

The IRS has changed to the address to which questions about the program may be submitted. Questions may either be submitted to Internal Revenue Service, Attn: Substitute Forms Program, SE:W:CAR:MP:P:TP:TP, NCFB, 5000 Ellin Rd., Mail stop C-110, Lanham, MD 20706, or emailed to [email protected].

Issue 18: Understanding Federal Tax Obligations During Chapter 13 Bankruptcy Tax Tip 2022-133

Bankruptcy is a last resort for taxpayers to get out of debts. For individuals, the most common type of bankruptcy is a Chapter 13. This section of the bankruptcy law allows individuals and small business owners in financial difficulty to repay their creditors. Chapter 13 bankruptcy is only available to wage earners, the self-employed and sole proprietor businesses.

Tax obligations while filing Chapter 13 bankruptcy:

- Taxpayers must file all required tax returns for tax periods ending within four years of their bankruptcy filing.

- During a bankruptcy taxpayers must continue to file, or get an extension of time to file, all required returns.

- During a bankruptcy case taxpayers should pay all current taxes as they come due.

- Failure to file returns and pay current taxes during a bankruptcy may result in a case being dismissed, converted to a liquidating bankruptcy chapter 7, or the chapter 13 plan may not be confirmed.

Other things to know:

- If the IRS is listed as a creditor in their bankruptcy, the IRS will receive electronic notice about their case from the U.S. Bankruptcy Courts. People can check by calling the IRS’ Centralized Insolvency Operation at 800-973-0424 and giving them the bankruptcy case number.

- If one of the reasons a taxpayer is filing bankruptcy is overdue federal tax debts, they may need to increase their withholding or their estimated tax payments.

- People can receive tax refunds while in bankruptcy. However, refunds may be subject to delay or used to pay down their tax debts.

Other types of bankruptcy

Partnerships and corporations file bankruptcy under Chapter 7 or Chapter 11 of the bankruptcy code. Individuals may also file under Chapter 7 or Chapter 11. Other types of bankruptcy include Chapters 9, 12 and 15. Cases under these chapters of the bankruptcy code involve municipalities, family farmers and fisherman, and international cases.

Issue 19: IRS Funding Secured, Treasury Chief Outlines 6-Month Plan

Treasury Secretary Janet Yellen reiterated that more than half of the funds allocated to the IRS in the Inflation Reduction Act (IRA of 2022) will be used for improving compliance and enforcement.

Yellen said the increased IRS funding will not result in more audits for working- and middle-class families. She added that audit levels should stay the same for households with less than $400,000 in annual income and that audit rates for those households should decline in future years because of improvements to IRS infrastructure.

According to Yellen, the increased funding will also be used to:

- Fully staff every IRS Tax Assistance Center and increase the number of taxpayers served in person by the centers from 900,000 in 2019 to 2.7 million for the 2023 tax season

· Taxpayers have also been unable to, for the most part, resolve issues over the phone due to a high call volume. “During the most recent filing season, the IRS averaged a 10-15% level of service, meaning that it answered less than two of every 10 calls,” Yellen said. The amount set aside in the inflation bill for improving the customer experience will be used to bring on 5,000 additional phone representatives, who will aim to reduce wait times from the 2022 filing season average 30 minutes to less than 15 minutes.

· To address the slow processing turnaround times for paper returns, Yellen announced that the IRS will begin automating “the scanning of millions of individual paper returns into a native digital copy.” This is intended to deliver returns to taxpayer in a timelier fashion while preventing a bigger backlog of outstanding paper return inventory. Further, communication lapses stemming from paper mail notices will be possibly rectified by allowing “millions of taxpayers” to receive and respond to IRS correspondence online.

- Consult with customer service providers in the private sector to get outside views on how the agency should use new technology to improve its customer service

Issue 20: IRS advises That Improperly Forgiven Paycheck Protection Program Loans are Taxable Chief Counsel Advice 202237010

The Internal Revenue Service recently issued guidance addressing improper forgiveness of a Paycheck Protection Program loan (PPP loan).

The guidance confirms that, when a taxpayer’s loan is forgiven based upon misrepresentations or omissions, the taxpayer is not eligible to exclude the forgiveness from income and must include in income the portion of the loan proceeds that were forgiven based upon misrepresentations or omissions. Taxpayers who inappropriately received forgiveness of their PPP loans are encouraged to take steps to come into compliance by, for example, filing amended returns that include forgiven loan proceed amounts in income.

Many PPP loan recipients who received loan forgiveness were qualified and used the loan proceeds properly to pay eligible expenses. However, the IRS has discovered that some recipients who received loan forgiveness did not meet one or more eligibility conditions. These recipients received forgiveness of their PPP loan through misrepresentation or omission and either did not qualify to receive a PPP loan or misused the loan proceeds.

The PPP loan program was established by the Coronavirus Aid, Relief and Economic Security Act (CARES Act) to assist small US businesses that were adversely affected by the COVID-19 pandemic in paying certain expenses. The PPP loan program was further extended by the Economic Aid to Hard-Hit Small Businesses, Nonprofits and Venues Act.

Under the terms of the PPP loan program, lenders can forgive the full amount of the loan if the loan recipient meets three conditions.

1 – The loan recipient was eligible to receive the PPP loan. An eligible loan recipient:

- is a small business concern, independent contractor, eligible self-employed individual, sole proprietor, business concern, or a certain type of tax-exempt entity;

- was in business on or before February 15, 2020; and

- had employees or independent contractors who were paid for their services, or was a self-employed individual, sole proprietor, or independent contractor.

2 – The loan proceeds had to be used to pay eligible expenses, such as payroll costs, rent, interest on the business’ mortgage, and utilities.

3 – The loan recipient had to apply for loan forgiveness. The loan forgiveness application required a loan recipient to attest to eligibility, verify certain financial information, and meet other legal qualifications.

If the 3 conditions above are met, then under the PPP loan program the forgiven portion is excluded from income. If the conditions are not met, then the amount of the loan proceeds that were forgiven but do not meet the conditions must be included in income and any additional income tax must be paid.

To report tax-related illegal activities relating to PPP loans, submit Form 3949-A, Information Referral. You should also report instances of IRS-related phishing attempts and fraud to the Treasury Inspector General for Tax Administration at 800-366-4484.

Issue 21: Chief Counsel Outlines When Contracted Work Qualifies for Research Credit – Legal Advice Issued by Field Attorneys 20223401F

In a Field Attorney Advice, the IRS Chief Counsel’s Office addresses what research activities conducted by a contractor are “unfunded activities” eligible for the research credit.

§ 41 allows a credit for qualified research expenses above a certain base amount. These expenses can be incurred for either in-house or contracted research. Qualified research does not include any research funded by a grant, contract, or otherwise by another person (such as a government grant or contractual payments).

Requirements for unfunded research expenses. Generally, research performed for a client or customer under a contract is “unfunded research” when:

1. the amounts payable to the contractor under the contract are contingent on the success of the research (i.e., the customer is paying for the product or result of the research); and

2. the contractor retains substantial rights in the research (i.e., the contractor retains patent rights or other rights to the research). (Reg. § 1.41-4A(d))

According to the Advice, each project expense must be considered when determining whether research is funded or unfunded. This is because a contractor may, in the same contract, agree to perform some research in which the client pays for the resulting product and some research in which the client pays only for the research itself.

The Advice also said that whether a contractor has retained substantial rights to the research is determined on a project-by-project basis. However, substantial rights don’t include incidental benefits to the contractor, such as increased experience in a field of research. In addition, the contractor does not have substantial rights to the research if they must pay for the right to use the research.

The Advice concluded that the contractor was not entitled to claim a research credit because none of the research the contractor provided was unfunded. Although the contract details were redacted, the Advice found that either the amounts payable to the contractor weren’t contingent on successful research or the contractor didn’t retain substantial rights to the research.

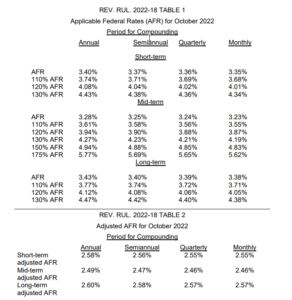

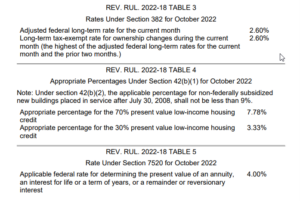

Issue 22: Applicable Federal Rates for October2022, Rev. Rul. 2022-18